April 5, 2022 By Grace Pratt, Policy Analyst

Executive Director Blog Post: PG&E & CC Power Storage Solicitations — The Opening Salvo for “A Decade of Execution”

January 27, 2022

By Alex Morris, Executive Director

Energy storage in California started the new year with a jolt. Late last week, investor-owned utility Pacific Gas & Electric (PG&E) announced it intends to deploy nearly 1,600 megawatts (MW) of incremental battery energy storage by mid-2024. The announcement is just one of the first in what promises to be a very active year – and decade -- for the state’s energy storage industry.

Congratulations to CESA members Terra-Gen, Strata, NextEra Energy, and Arevon (working with Tenaska), which together will contribute seven projects totaling about 1,150 MW. If approved, the projects will come online between August 2023 and June 2024.

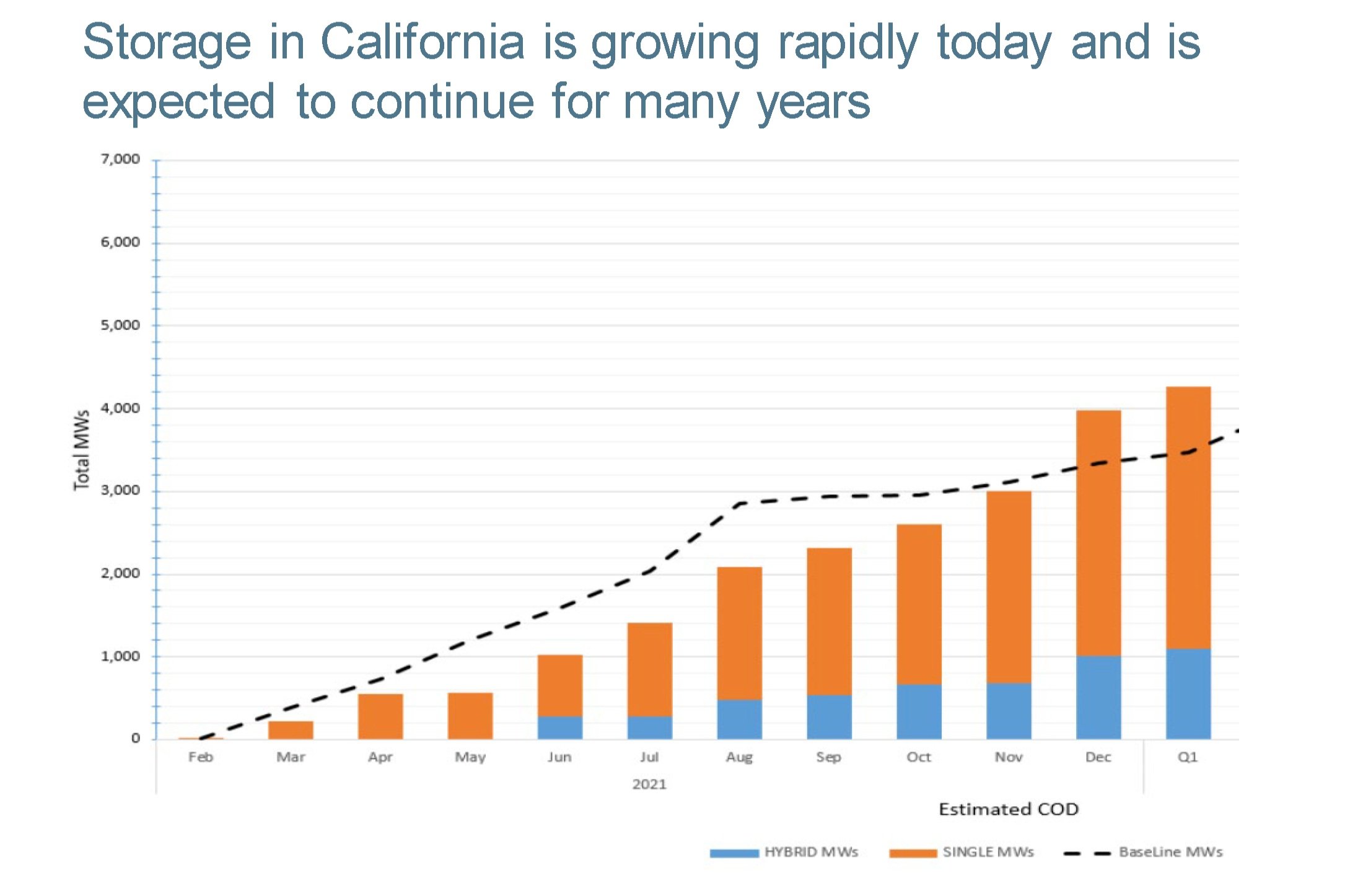

This mega-procurement announcement follows a banner 2021 for storage deployment. California – already the world’s largest and most mature storage market – increased its grid-connected storage capacity to almost 4,000 MW at year-end, from less than 500 MW in the summer of 2020.

PG&E’s procurement, selected from 73 bids, is the latest sign that the California storage market has transitioned from a state of market development to one of market execution and optimization. By updating traditional procurement sizes of tens and hundreds of MWs by an order of magnitude, this solicitation hints at the scale of market growth being realized in California. Considering the California Public Utilities Commission (CPUC) estimates the State will require approximately 14 gigawatts (GW) of storage by 2032, procurements in terms of GW likely will become more frequent.

January’s procurement news is not limited to 4-hour energy storage. As CESA’s special project Long Duration Energy Storage for California's Clean, Reliable Grid noted, California needs at least 45 GW of long duration energy storage (LDES) by 2045 to reliably and cost-effectively meet decarbonization goals. Underscoring the importance of LDES, the CPUC issued Decision 21-06-035, requiring load-serving entities to procure 1 GW of new long-duration storage in the next 5 years.

In light of this directive and the growing need for long duration storage, California Community Power (CC Power), an organization comprised of seven community choice aggregators (CCAs), approved entering into an energy storage service agreement with REV Renewables for 69 MW (552 megawatt hours (MWh)) of 8-hour storage. The REV Renewables Tumbleweed project will be located near Rosamond, in Kern County, California, with an expected online date of 2026. This project will satisfy approximately 55% of the D.21-06-035 LDES requirements of CleanPowerSF, Peninsula Clean Energy, Redwood Coast Energy Authority, San Jose Clean Energy, Silicon Valley Clean Energy, Sonoma Clean Power Authority and Valley Clean Energy. Additionally, Central Coast Community Energy (3CE) is contracting for four storage projects via a VRB Flow Battery to the tune of 42 MW (266 MWh), with three of the four projects being long-duration storage.

These two procurements demonstrate the pivotal role that energy storage, in all its forms, will play in the decarbonization of California’s economy.

At CESA, we are proud to be the voice of storage in shaping and accelerating the role of energy storage in the electric power sector and speeding the transition of the state’s grid to a more affordable, efficient, reliable, safe, and sustainable system. We are in final preparations for our 13th annual Market Development Forum, to be held March 1-2 in Berkeley, California. Its theme of “A Decade of Execution,” is an apt one as we analyze the very dynamic operating landscape around us and work together to chart a course that moves the market forward and ensures our 100+ members will continue to play a key role in California’s clean energy evolution. If you are interested in joining us in March or in becoming a CESA member, please contact our Membership Manager Emily Yan at eyan@cesa.org.

Preparing my remarks for the final ESACon conference earlier this month, I got a bit nostalgic when I began to reminisce about the first shows I attended and how much our industry has grown over the past decade, particularly in the last few years.

Source: California ISO

Today, there’s no doubt about the foundational role energy storage plays in supporting a resilient, reliable, clean, and flexible electric grid in California, the world’s largest and most mature market. Energy storage is unquestionably a success story for the state — and a technology that I believe California’s grid operator and its consumers now cannot live without.

Not only does California need a robust storage infrastructure to support its ambitious decarbonization goal to procure 100% of its electricity from renewable energy resources by 2045. As thermal retirements continue, and with additional major closures planned, including the 2.2 GW Diablo Canyon nuclear facility by 2025, California’s grid operator must integrate thousands of megawatts of new, variable clean energy resources like wind and solar generation with little to no disruption to normal grid operations. Add to this mix the impacts of climate change, including historically low hydropower resources from low mountain snowpack and ongoing drought, as well as extreme heat waves that drive up customer demand, and the value streams that energy storage delivers become increasingly valuable and necessary.

The most immediately salient value storage provides for California, however, is that the exponential growth of operating grid-connected storage in the state — a 6-fold increase for standalone storage, from about 500 MW in summer of 2020 to over 3,000 MW by the end of 2021 — helped to save it from rolling blackouts during this past summer’s massive heatwave. Think about it: The world’s 5th largest economy and contributor of 15% of U.S. GDP now needs our industry to help keep the lights on. Quite the change from just one year ago!

As the state continues to expect our industry to deliver, we need to deploy storage even more quickly and efficiently. The California Energy Storage Alliance (CESA) estimates California will need at least an additional 10,000 MW of new storage in the next decade. Doing so requires a big shift in focus from one of theory and frameworks to one of execution.

Financing and contracting mechanisms require greater certainty. Stable market signals, clear pricing, and longer-lead times in procurement will reduce costs for California by enabling more market entry for emerging storage technologies and lowering financing barriers. Standardized contracts, reduced negotiation and approval times, and cooperation and understanding among permitting authorities is also essential.

Owners and operators have to contend with and master vital functions including long-term operations, ongoing market participation, scheduling, and maintenance. From a safety perspective, the state has work to do on streamlining the process for safe siting and permitting of these systems, as well as training first responders in how to deal with systems designed to hold very large quantities of energy.

Add it up, and we as an industry have a lot of work ahead of us. As a membership-based organization, CESA is committed to building trust among key stakeholders and ensuring our industry continues to underscore the increasingly critical role energy storage plays in preserving California’s role as an innovation engine and a clean energy leader. The strength of our 100+ member network is our greatest asset as we work together to support our industry’s next phase of growth.

To learn more about CESA and the vital role it plays in accelerating California’s grid modernization, please contact our Membership Manager, Emily Yan