May 25, 2017

Jin Noh, Policy Manager

Imagine you run a small business. You incur a number of business expenses, ranging from direct labor, to cost of materials, to freight and others. Normally, these expenses would be deductible since they are part of the cost of doing business.

Now imagine you are the only business that is not allowed to deduct these expenses from your taxable income. That would be entirely unfair and likely make your business less competitive compared to competing firms that are able to deduct these expenses, thereby increasing their operating profit. Your business would likely struggle to keep up with the competition due to this unfair treatment.

This is approximately the situation that has been faced by energy storage resources competing and selling services into the wholesale energy markets. These discriminatory circumstances result from rules and treatment of what is known as “station power” for energy storage systems – an esoteric, but important concept. While the above example is not a perfect corollary to the station power dilemma faced by energy storage operators, it serves as a useful analogy to explain how energy storage market participants are at a disadvantage due to fine-print details for station power in wholesale and retail electric tariffs.

While much progress has been made in extending wholesale market access to energy storage systems, recent refinements by the California Public Utilities Commission are now more appropriately defining station power. The new definitions for station power delineate which electrical loads and costs for energy storage systems are “inessential” to system operations, and thus charged at retail rates, versus which loads are “essential” to system operations and thus charged at lower wholesale rates. The new rules also apply an important but somewhat complicated ‘netting’ concept to energy storage station power loads to more evenly position storage with traditional large fossil fuel generators (detailed more below).

An energy storage site includes a number of different loads that require energy from the electricity grid to support the energy storage system’s operations, including power conversion systems, battery management system controllers, thermal regulation systems, and facility lighting, among many others. By incorrectly categorizing certain site loads as inessential station power loads subject to retail rates (instead of wholesale), the applicable tariffs may be harsh and discriminatory for energy storage system loads that are essential for its operations. Per the analogy above, it is a case of being unable to deduct some business expenses that competitors can deduct.

Historically, California’s investor-owned utilities used broad definitions for station power in their pro forma energy storage agreements to include, for example, cooling and other thermal regulation equipment, which, based on the operations of many storage systems such as batteries, are essential loads for the safe, reliable, and optimal operations of battery storage systems. The California Independent System Operator (CAISO) also defined station power in its rulebook, a.k.a. ‘the tariff[1]’, as all the energy used (loads) by the generation facility, which includes loads that are essential for operations (e.g., thermal regulation, pumps, compressors, SCADA equipment), but also incidental or non-essential loads (e.g., lighting, security systems, coffee pots, offices). Without a clear-cut standard for which loads constitute station power when energy storage systems are charging or idle, utilities are negotiating station power treatment on a case-by-case for each storage project.

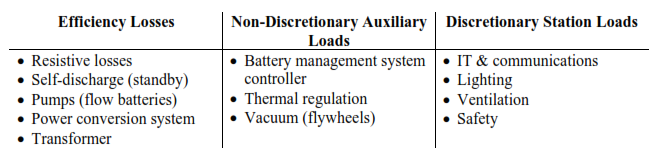

To delineate the different loads associated with an energy storage system, CESA helped propose a framework that differentiates the loads as those that are unavoidable to the “production” or “conversion” of energy drawn from the grid (efficiency losses), those that integral to the optimal “production” or “conversion” of energy drawn from the grid (non-discretionary auxiliary loads), and those that are end-use loads that have no bearing on the “production” or “conversion” of energy drawn from the grid.

As mentioned, this delineation was approved in a CPUC Decision (D.17-04-039) in April 2017.[2] The CPUC recognized that loads that we termed “efficiency losses” are inherent loads that should be treated at wholesale rates because they factor into the direct production or conversion of energy to be stored in the energy storage unit with the intent of reselling later to provide various grid services; these loads cannot be turned off while the energy storage device is in operation.

Meanwhile, the CPUC also recognized that loads that we termed “non-discretionary auxiliary loads” should also be treated at wholesale rates because they are essential to optimal roundtrip efficiencies. Since energy storage is a broad technology class, this definition applies to an energy storage device’s roundtrip efficiency (RTE) in different ways. For battery storage systems, the need for thermal management systems can affect the RTE. For flywheels, by contrast, vacuums are needed to minimize drag on the rotor to maximize efficiency and minimize standby losses. In all cases, however, these auxiliary loads are necessary to the safe, efficient, and enduring operation of energy storage devices.

Finally, the CPUC determined that station power loads are those such as lighting for the facility and HVAC for facility personnel that do not affect the throughput of the device and could be turned off without physically affecting the operation of the device. These are appropriately deemed “discretionary” and charged at retail rates.[3]

Relatedly, D.17-04-039 determined that “permitted netting” against the absolute value of an energy storage system’s charge and discharge should be allowed for in-front-of-the-meter (IFOM) energy storage. Permitted netting is an accounting solution that requires auxiliary loads to be netted from the energy storage plant’s output during some interval and settled at wholesale rates, without having energy storage systems list and differentiate wholesale versus retail for every load. As long as the absolute value of the charging or discharging is greater than the auxiliary loads, netting at wholesale rates is permitted for these loads. Permitted netting was not previously allowed for IFOM energy storage charging as it was viewed as load, rather than “negative generation” or energy to be later discharged for resale on the wholesale market.

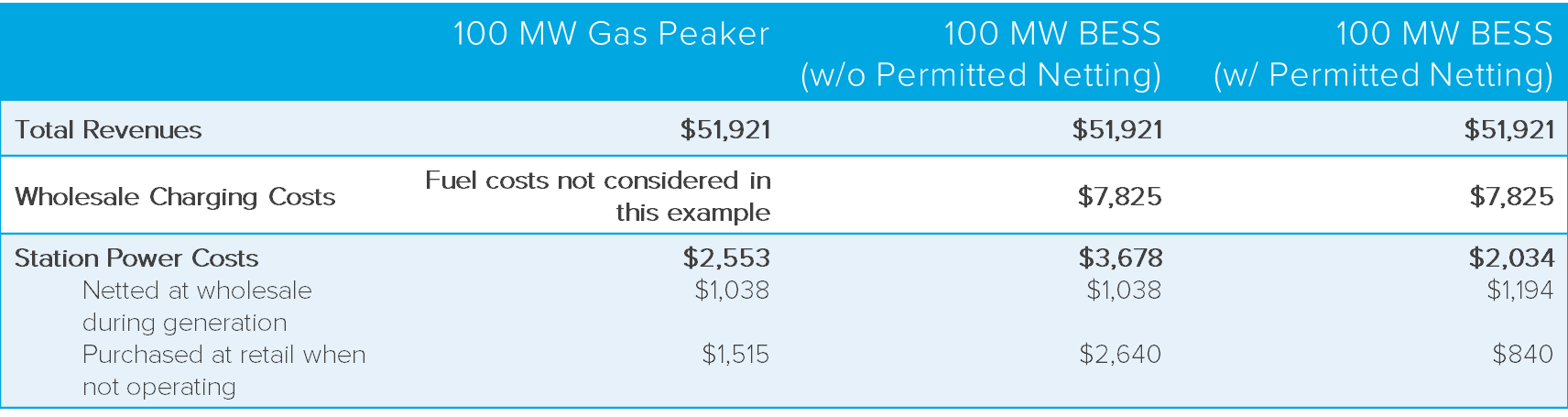

While wonky, the allowance of permitted netting for IFOM energy storage represents a major development that places it on more even ground with conventional generation, which is allowed to net its auxiliary loads. LS Power, an energy storage project developer and CESA member, created a market model on how a 100-MW gas peaker plant compares to a 100-MW battery storage system with and without permitted netting and demonstrated how this rule change drastically reduces operating costs as well. The results (recreated below) demonstrate how permitted netting rules for gas peakers (but not for IFOM battery storage systems) create an additional $1,000 station power cost for the latter.

There are still some uncertainties related to these new station power rules. CESA is working with the CPUC and the CAISO on developing specific metering configurations to implement the revised station power rules. Furthermore, the CPUC defers approval of revised station power rules for sub-metered behind-the-meter (BTM) energy storage resources participating in the wholesale market until further development of multiple-use application protocols, processes, and specific metering configuration options. Understandably, there are aspects to BTM energy storage systems that cross the wholesale-retail divide – another area where CESA is working closely with the CPUC and the CAISO to resolve.

Overall, the new station power rules represent a precedent-setting achievement for the energy storage industry, even while it may have been lost in the shuffle with more headline-grabbing news and stories. The impact on reducing operating costs and establishing an equal playing field with other resources is no small feat and represents a huge step for the industry. Once again, California is leading the nation on enabling fair wholesale market access to energy storage technologies, and other markets may soon follow suit with similar “boring” but vital market design considerations.

[1] CAISO Tariff Appendix A.

[2] The CPUC determined that “all energy that is consumed (and not resold) for purposes other than for supporting a resale of energy back into wholesale markets is station power and inherently retail, subject to the CPUC’s rules regarding netting of energy consumption” while “all energy drawn from the grid to charge energy storage resources for later resale, including energy associated with efficiency losses should be subject to a wholesale tariff.”

[3] This is where the analogy for tax deductible business expenses falls apart, as cursory online research shows that coffee machines and ping pong tables are tax deductible for small businesses in certain circumstances, even though it is debatable whether this is essential for business operations.